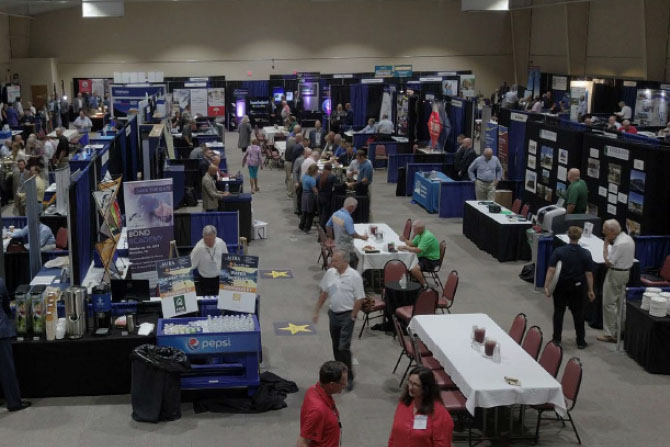

Throughout our district, entrepreneurship serves as an economic engine, provides jobs and generates income within the local area. In regions where larger corporations may not have a presence, small businesses often fill the void, offering employment opportunities to residents who may otherwise struggle to find work locally. This not only helps to reduce unemployment rates but also strengthens the local economy by circulating money within the community. Small businesses contribute to the unique character and identity within our Mainstreets, reflecting the cultural heritage and values of the community and offering products tailored to local needs and preferences. Businesses foster a sense of community pride and connection as their neighbors support establishments that they know and trust.

Being that small businesses are the lifeline for many, the fear of the government stepping in and shutting them down is the worst thing imaginable. We saw the grave impact widespread shutdowns had on communities in 2020, so it’s hard to imagine a situation where this would happen unless it was truly necessary. But let’s rewind to Operation Choke Point in 2018. Bureaucrats from different government agencies decided to cut off certain legal businesses that were doing legal business, like antique shops and car dealers, from the banking system. It was shockingly easy for them to do this within the rules of U.S. regulations. The Federal Deposit Insurance Corporation (FDIC) officials just had to tell the banks they supervised that the government saw some of their customers as “high risk.” This alone was enough to intimidate the banks to close these customers’ accounts. Banks really don’t want any trouble with the government, so they did what they were told, even though it meant losing customers. What’s scary about all this is that it shows how much power federal regulators have and how they abuse it by going after law-abiding citizens.

The FDIC has a long history of a lack of accountability; in recent weeks, they have made the news yet again but for a different reason. The revelations surrounding the FDIC’s toxic work environment released in the Cleary Report highlight systemic failures in oversight and lack of leadership that extend beyond its walls, impacting the broader banking sector. This lack of accountability poses significant challenges for banks, regardless of size, as they grapple with heightened scrutiny and uncertainty regarding regulatory practices. Without clear commitments to accountability and transparency from regulatory authorities, banks face increased regulatory risks and reputational damage. In the aftermath of the report damaging the FDIC’s workplace culture, the lack of accountability within regulatory agencies has become a pressing concern that calls for immediate intervention and a change in leadership.