By Carl White, Senior Vice President, Supervision, Federal Reserve Bank of St. Louis

Proud. Overwhelmed. Frustrated.

These sentiments and others expressed by bankers come from the 2020 National Survey of Community Banks, conducted annually by the Conference of State Bank Supervisors (CSBS) and state banking regulators for the past seven years. The survey is released each year during the annual Community Banking in the 21st century research and policy conference; the event is sponsored by the Federal Reserve, the CSBS and the Federal Deposit Insurance Corporation. In this year’s survey, the effects of COVID-19 dominated and colored typical industry concerns related to regulatory burden, small business lending, industry consolidation, competition and technological innovation.

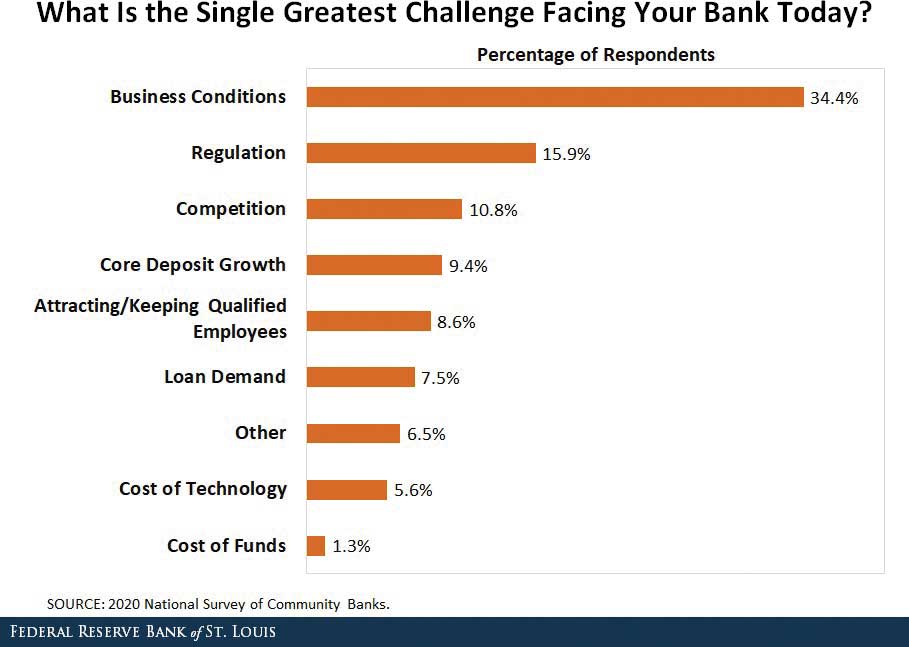

In last year’s survey, funding— its cost and availability —was cited as the greatest challenge by the bankers surveyed. This year, “business conditions” took the top spot. Community bankers faced a changed and daunting banking environment and had workplace issues of their own to manage, but they were also able to take advantage of their deep community connections to step up and help their local economies. Regulatory burden, competition and core deposit growth still remain important concerns, but the uncertainty created by the COVID-19 pandemic certainly impacted community bank views on the challenges they would be facing in the months ahead.

A Changed Landscape

While banks of all sizes faced myriad challenges from the pandemic and its economic consequences, community banks played a large role in one of the major strategies to mitigate the damage: the Paycheck Protection Program (PPP). The PPP — established under the Coronavirus Aid, Relief and Economic Security Act — was administered by the Small Business Administration (SBA) and guaranteed the extension of potentially forgivable loans to allow participating employers to keep workers on their payrolls. PPP loans were made by qualified lenders to small businesses with fewer than 500 employees.

PPP loans made by community banks accounted for nearly 40% of the total extended under the program. But it wasn’t easy. Bankers surveyed numerous detailed challenges, including changing rules and procedures for loan processing, glitches with the SBA website and issues related to the “first-come, first-served” approach to approving customer requests. Community banks incurred numerous costs from program participation, such as inefficiencies because of the small size of many loans and some reputational damage from disgruntled customers who held banks responsible for any glitches. Nevertheless, a number of surveyed bankers said the struggles were worth it. As one banker put it, “Despite a rollout that was disjointed and frustrating, we were able to support our small business customers.”

Beyond the PPP

Community bankers took other steps to help their customers. More than a third of those surveyed reported they reduced or eliminated late-payment penalties on credit cards or loan payments. A similar percentage reduced or eliminated fees on deposit accounts. Many banks took less traditional steps to help out their customers and communities, such as boosting their Wi-Fi hot spots so students without adequate internet access could do homework from the bank parking lot.

While community banks helped businesses in their communities stay on their feet, they also needed to protect their own financial interests. Many community banks increased their loan loss reserves, with three-quarters of surveyed bankers citing economic conditions and credit repayment issues as primary motivators. Almost a quarter of surveyed bankers report at least a temporary closure of a branch. Nearly three-quarters of community banks implemented a work-from-home policy in response to COVID-19, and almost 95% reported no layoffs. Some bankers noted that these transitions were easier than expected, partially because they had made prior investments in technologies that facilitated the changes.

Nearly three-quarters of community banks implemented a work-from-home policy in response to COVID-19, and almost 95% reported no layoffs. Some bankers noted that these transitions were easier than expected, partially because they had made prior investments in technologies that facilitated the changes.

Looking Ahead

The near-term outlook for community banks is highly dependent on the speed of economic recovery, which is tied to suppression of the pandemic through public health measures and medical interventions like vaccines. While many institutions will no doubt suffer losses, some bankers are choosing to accentuate the positive, like the advantages that come with relationship-based banking. One surveyed banker summed it up like this: Loans during the pandemic “were never transactional matters. We were presented with several opportunities by bank customers who simply couldn’t get a loan from their large corporate-style banks. Their loss is our gain.”