The FASB’s new credit loss model is one of the most significant accounting changes in recent history. The time to act is now — here’s how you can prepare and comply.

In June 2016, the Financial Accounting Standards Board (FASB) issued a new expected credit loss accounting standard, which introduced an updated method for estimating allowances for credit losses. This is referred to as the Current Expected Credit Losses methodology (CECL) and applies to all banks, savings associations, credit unions, and holding companies.

If your institution has not yet adopted CECL, now is the time to refresh yourself on the key changes and — most importantly — to start planning.

What is CECL?

The impairment model introduced by the CECL standard is based on expected losses rather than incurred losses. With that, an entity recognizes its estimate of lifetime expected credit losses as an allowance. CECL also strives to reduce complexity by decreasing the amount of credit loss models available to account for debt instruments.

This change was under discussion for many years prior to its issuance, with the impacts of the global economic crisis highlighting the shortcomings of the Allowance for Loan and Lease Losses (ALLL) framework. FASB concluded that the ALLL approach delayed the recognition of credit losses on loans and resulted in loan loss allowances that

were insufficient.

“There are a lot of decisions that need to be made. By starting as early as you can, you avoid any roadblocks in getting CECL implemented by the deadline.” – Brian Lewis, RMSG Senior Risk Advisor.

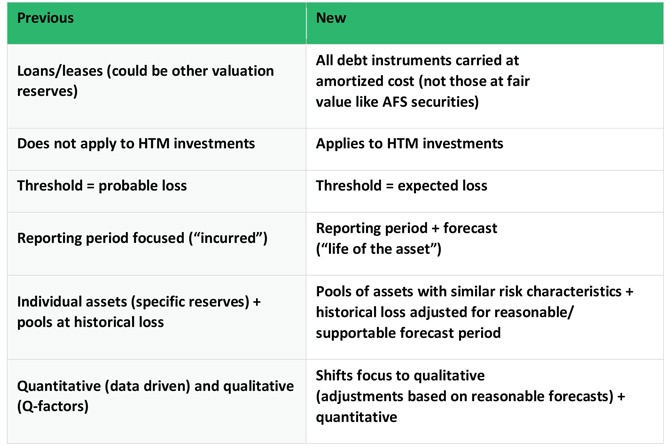

Differences between the previous and the new standards

How will CECL impact my institution?

Adoption of the new standard will influence internal controls and information likely not previously integrated into financial reporting efforts. In other words, the scope of CECL is far-reaching — spanning corporate governance, modeling, credit analysis, technology, and others. Additionally, CECL affects all entities holding loans, debt securities, trade receivables, and off-balance-sheet credit exposures. In short: it will have significant implications for operations at most financial institutions.

How to proceed toward CECL transition

The time to get started — if you haven’t already — is now. This is a significant change with extensive effects and potential risks. Careful — and early — planning is key. Here are nine key steps institutions can take to achieve CECL compliance:

- Identify functional areas (such as lending, credit review, audit, management, and board) that need to participate in the transition project/ implementation and ensure these areas are familiar with the new standard

- Determine your effective date and whether to early adopt

- Make a project plan and timeline

- Discuss the plan and progress with all stakeholders as well as your regulator

- Determine the ACL estimation method/methods to be used

- Identify available data and any other data that may be needed

- Identify potential system changes

- Evaluate and plan for the potential impact on regulatory capital

- Have a clear, well-understood process

Finally, it’s necessary to take a holistic view to ensure a smooth transition, including:

- Build in testing for data integrity and method estimation validation

- Update other bank policies and reports so they are consistent with processes

- Consider running parallel with the ALLL to evaluate risks

- Back-test as part of supporting modifications and improvements

What are the implementation timelines?

This standard was effective for many institutions by December 2019, and all others will need to comply by March 2023. These dates are based on the Public Business Entity (PBE) status for institutions. Early adoption was allowed for any institution after December 2018.

How can RMSG help?

Risk Management Solutions Group (RMSG) offers a comprehensive suite of regulatory and compliance services for community and midsize banks. Customized to your unique business needs, our consulting services are delivered by experienced subject matter professionals — all at an accessible price.

When it comes to CECL, it’s important to start planning now to ensure you meet deadlines and minimize risk. We can help you with:- Understanding the requirement and how your community or midsize bank can achieve compliance

- Consideration around various CECL methodologies and which may best apply to your organization

- Reviewing your processes to make sure they are sustainable, manageable, and consistently applied — now and into the future

Contact us for a complimentary and confidential risk management consultation. 866.825.6793, riskmsg.com.

RMSG is a wholly owned subsidiary of Bankers Healthcare Group. To learn more about RMSG visit riskmsg.com.