Core deposits, especially low-cost core deposits, have long been the key driver for franchise value in the financial services industry. That said, with the start of the pandemic and the ensuing influx of cash from stimulus checks and increased personal saving rates, financial institutions saw so much excess liquidity that bankers began to question the value of any deposits, including low-cost core deposits.

Total deposits in FDIC-insured banks grew by over five trillion from the end of 2019 to the end of 2021. In the two years prior, deposits had grown just over one trillion. These same trends on a smaller scale held true for credit unions.

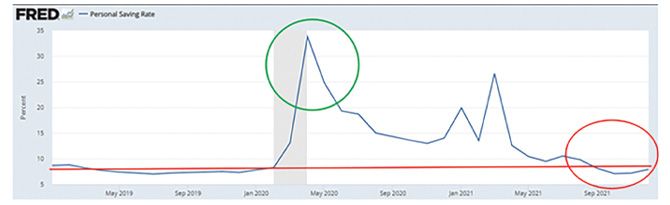

Peak deposit growth happened in 2020. By September 2021, the personal saving rate was back at pre-pandemic levels. Deposits at financial institutions continued to grow, but at a much slower rate than in 2020. Finally, in March 2022, the data showed personal checking account balances dropped for the first time since Q3 2021. (See Graph Below)

In addition, consumer spending is now soaring. According to a recent article in Bloomberg, the top four banks in the nation have seen a 27% average increase in consumer credit card spending for Q1 of 2022 vs. Q1 of 2021.

Inflation is at record highs, and Federal Reserve Chairman Jerome Powell indicated in his most recent speech that multiple 50bp rate hikes should be expected in the remainder of the year, and as early as June and July.

Unlike in previous rising-rate environments, financial institutions haven’t felt the same pressure to raise rates yet in light of the excess

liquidity in the system. That said, financial services analysts expect deposit betas in the 25-50% range over the next two to three years. For financial institutions, that means passing 25-50% of these rate increases on to our depositors. That is significant, and the response will not be the same for all institutions.

Given this variety of possible responses, we anticipate seeing rate offers from financial institutions — most likely led by online and digital banks, with community-based financial institutions following at a slower pace and on a smaller scale. Assuming the bulk of this effort won’t happen until 2023 and beyond, the question financial institutions must ask themselves is, “What should we do now?”

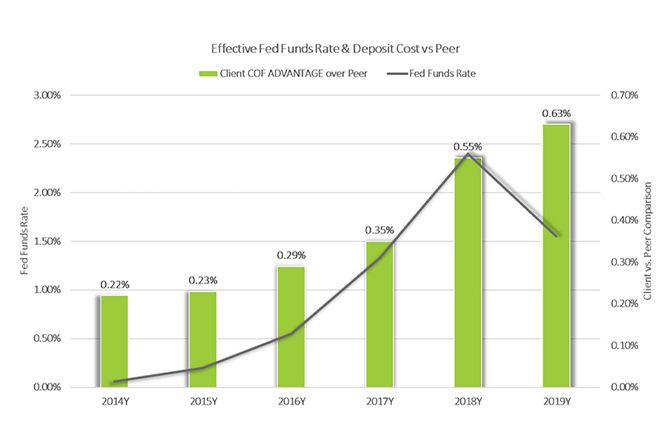

Institutions with low-cost and less rate-sensitive funding are well-positioned for any rate environment, but especially for the one we are about to enter. The chart below illustrates what the deposit cost advantage looks like when a financial institution has a lower cost of funding. The rate environment we are entering is similar to what we saw in 2016-2018. As rates were rising, the deposit cost advantage over peers dramatically changed. In a low-rate environment, it was small but grew to 63bp when rates were at the level we expect to see again in 2023-2024.

Strategically growing low-cost funding today is the key to successfully positioning your organization for tomorrow. Even if you have excess liquidity at the moment, there isn’t a better time to grow low-cost funding by growing your customer base and increasing your checking and savings deposits. The majority of these funds will be non-interest bearing, and those that are interest-bearing will be at the lowest rates.

To position your financial institution for the coming battle for deposits, it is imperative that you:

- Offer compelling retail and business deposit products;

- Remove barriers to growth (e.g., evaluate your Customer Identification Program);

- Use data-driven targeted marketing to reach high-probability conversion prospects; and

- Equip your employees with the skills to capitalize on every opportunity every time.

If your strategic goals include low-cost funding and a strong position in any rate environment, you have to be intentional about growth. If you focus on growing core relationships, you will not have to follow other institutions up and down the rate cycles.

Achim Griesel is president and Dr. Sean Payant serves as the chief strategy officer at Haberfeld, a data-driven consulting firm specializing in core relationships and profitability growth for community-based financial institutions. Achim can be reached at 402.323.3793 or achim@haberfeld.com. Sean can be reached at 402.323.3614 or sean@haberfeld.com.