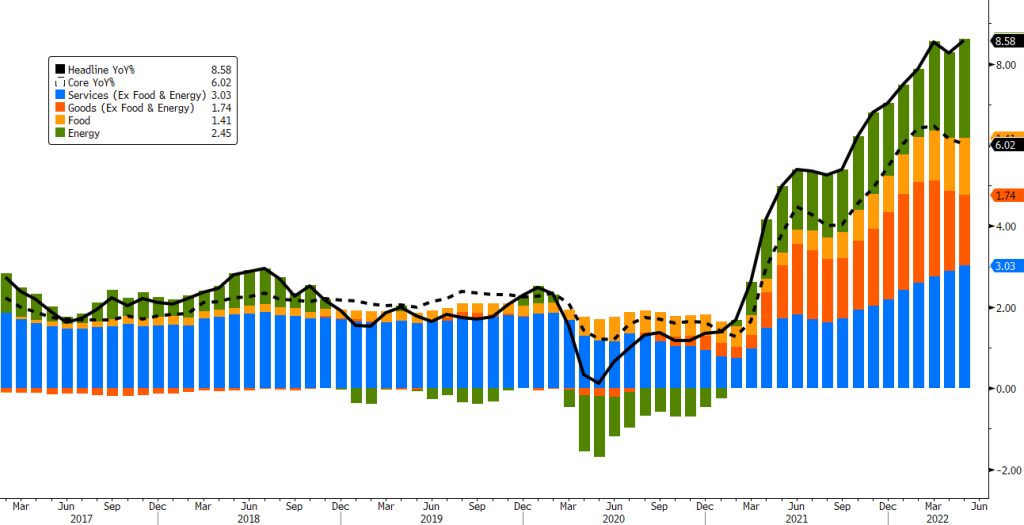

As if navigating the 2008 Housing Crisis and the 2020 Global Pandemic weren’t enough, banks now face the most feared economic monster of all – inflation. CPI YOY jumped by 8.6% in May of 2022, backed by broad price increases across many sectors. Obviously, this is well above the Fed’s normal target of 2% and increases the chances of more severe economic headwinds. If the Fed aggressively fights inflation through higher rates and balance sheet reduction, it will add significant downward pressure on consumers and the overall economy. If they are not aggressive enough, inflation can remain elevated for a longer period, also adding significant downward pressure.

Headline CPI – YOY% Change 02/10/2017 – 05/31/2022

I think everyone was hoping for a bit of a breather coming into 2022; however, we instead find ourselves in an equally challenging situation where asset pricing and ALM strategy are of the utmost importance. For most of the past 2+ years, it was income and capital pressures that kept many up at night. The good news is that today’s higher yields offer quick relief in those categories. Unfortunately, we now have some new pressures coming in the form of falling asset market values. While every institution is unique, the function of managing interest rate risk (and specifically market risk) can almost always be improved through the inclusion of EVE and Income Simulation results. Doing so is key when discussing overall asset pricing along with the difference between ALM results and executed strategy.

It’s important to note that the rate of change is just as important as the overall amount of change when it comes to asset/liability management. This is the reason asset pricing becomes so important in this type of volatile interest rate environment. The faster interest rates rise, the greater the negative impact on our EVE in particular. The main reason behind this is the fact that quick rate movements leave depository institutions very little time to react and adjust their asset yields. We can only add higher-yielding investments and write higher-yielding loans so fast. Often this means that the first few quarters during a rising rate trend can magnify and even potentially overstate our IRR risk as measured through EVE. So, what can we do to combat this?

Well, at least part of the answer is that we need to quicken the pace of asset repricing on our balance sheets. By no means am I implying that this is an easy task. However, it is extremely necessary and should be a top management and ALCO priority. Increased loan demand is a very welcome sight, especially after what we have experienced over the past two years. The tricky part is that those new loans need to be at or above current market levels to begin softening our EVE risk. It doesn’t help our IRR position to be adding loans at 2021 levels. The market currently expects Fed Funds to reach 2.50% to 3.00% by the end of this year and short investments (without credit risk) can easily earn us a 3% yield or more. All these factors must be taken into account when discussing and adjusting asset pricing strategies right now.

This is one of the reasons that including ALM results in every strategic decision is so critical. It greatly shortens our reaction time and reduces how far off the path we can find ourselves in volatile environments. 2022, and likely 2023, will require more frequent/active ALCO and strategic planning sessions. At the same time, we need to ensure that the decisions we make in those meetings are in line with the assumptions we use in our ALM documents. Otherwise, we are basing our strategic movements on outdated directions.

For example, what if our ALM assumes that new loan volume will keep up with market rates (in a rising rate environment) to increase yield and limit EVE risk? However, during our next ALCO/board meeting the temptation to continue generating additional loan volume by not raising loan rates is too strong for the board to pass up. We could end up with a significantly higher level of IRR than our ALM results originally showed. The same can certainly be said on the deposit side of things. So, our ALCO decisions and ALM assumptions must be kept in line to ensure consistent accuracy of future strategic planning.

This is the reason we must always be looking to define, measure and then manage our risks. Hopefully, many of you will already have this management process in place and find yourselves well prepared to handle this environment’s new challenges. For those who do not, there is still time to align your internal systems and improve your institution’s ability to react quickly and correctly. However, that window of opportunity is closing and now is the time to start having those conversations.

Andrew Okolski is a Senior Financial Strategist at The Baker Group. He works directly with clients in a broad range of areas including ALM, education, portfolio management, interest rate risk management, strategic planning, regulatory issues and wholesale market strategies for financial institutions. Contact: 800-937-2257, andyo@GoBaker.com.