By The Servion Group

After a dark year, there appears to be some light at the end of the COVID-19 tunnel. As such, many banking leaders are thinking about their post-COVID priorities. A recent survey by The Servion Group sought to gauge what banking leaders believe is most important as their banks emerge from the crisis.

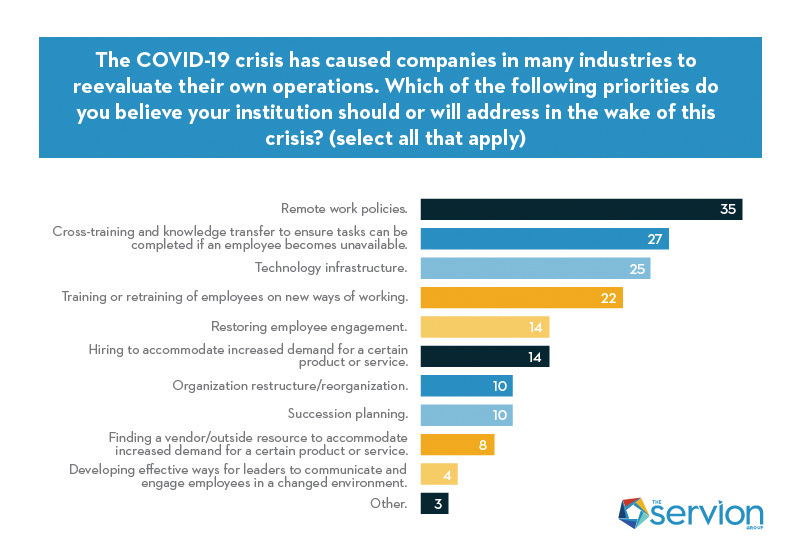

The survey asked, “What priorities do you believe your institution should or will address in the wake of this crisis?” The four particularly popular answers discussed below reveal that the pandemic era’s challenges may lead to permanent changes in the way banks operate.

This graph shows the survey question and all the available responses.

# 1. Remote Work Policies

The No. 1 survey response shows community banks are now giving some deep thought to their post-COVID remote work policies and with good reason.

According to The Financial Brand, work from home ability will be key to attracting and retaining talent in the future: “Flexible working arrangements are no longer a perk — they are becoming table stakes. Post-COVID, employees will see a loss of this newfound freedom as though they are not trusted by management despite the evidence that they’re performing more than well enough to be trusted.

Moreover, research from the International Workplace Group found that 80% of employees wouldn’t take a job that didn’t offer work-from-home flexibility. And, according to Buffer’s 2020 State of Remote Work Report, a remarkable 98% of employees said they want to work remotely at least part-time for the rest of their careers.

Community bank leaders are right to be thinking about the role of remote work in their workplaces. Leaders must engage with their employees, find out what they really want, and find a balance between home and office work that fits both the bank and its employees’ needs.

#2. Cross-Training and Knowledge Transfer

Community banks were faced with new challenges when employees had to quarantine due to being diagnosed with COVID, exposed to it, or to care for a loved one who had the virus. The unexpected absences of employees often left knowledge gaps within the organization and made it difficult to get things done. Survey respondents indicated that cross-training would be a major priority going forward, so there are multiple employees who know how to perform certain tasks, and nothing is dependent on one person.

#3. Technology Infrastructure

Technology infrastructure received the third-most votes in our survey. Applying and building on the lessons learned from the COVID-imposed work-from-home environment is something FI leaders should set as a goal. For community banks, it will be important to think about:

- Data security

- Customer data security

- Hardware and software designed for the modern digital environment

- Communications tools, including phone systems, meeting software and more

- Integrity and strength of IT security of vendor partners

#4. Training or Retraining Employees on New Ways of Working (Reskilling)

Community banks want to adapt employees’ skills and roles to a post-COVID environment. Putting the right people in the right places, and ensuring people have the right training, will help banks build resilience. Don’t be afraid to make bold moves and try new operating methods that make better use of your employees’ skillsets.

Global management firm McKinsey & Company calls this “reskilling” and offers several ideas to get started:

- Rapidly identify the skills your recovery business model depends on — for example, if you are moving from an in-branch focus to providing more digital services, you may need to bring on people with different skills or shift current employees who have the desired skills into new roles.

- Build employee skills critical to your new business model — help employees thrive in these four areas: digital skill, cognitive skill, social and emotional skill and adaptability/resilience skill.

- Start now, test and change — start reskilling your people now. Keep track of what works and what doesn’t, then try again. The idea is to progressively prepare your workforce to handle

new challenges. - Act like a small company to have a big impact — companies of under 1,000 employees are usually better at reskilling because they tend to be more agile and less bureaucratic. Large companies can do it too. It just tends to take longer.

- Budget for learning — companies slashed learning budgets after the 2008 crisis, which only forced them to spend heavily later. Keep learning in your budget this time around to avoid wasting years of opportunities to develop the efficiencies that come from real-time learning.

About The Servion Group

Founded in 1987, The Servion Group partners with community banks around the country to help them deliver mortgage, title, realty, business lending and financial advisory solutions to customers. Visit myservion.com or contact Mike Hart, account executive, at 417-894-2563 for more information.